-

Identifying and managing risk

Home » Sustainability » ESG » Identifying and managing risk

Home » Sustainability » ESG » Identifying and managing risk

Our governance framework is constantly evolving to align with global best practices of transparency, integrity, and accountability. We continue to improve our internal governance infrastructure to satisfy the changing business environment and expectations of our regulators, shareholders, business partners, customers, suppliers, employees and other stakeholders.

As we embark on an aggressive growth strategy, we must ensure that we have the proper internal control environment to keep up with the rapid pace of our business expansion. With this, in 2022, ACEN appointed a Chief Risk Officer, decoupling the role from the Chief Finance Officer, who then set up the Risk and Insurance Management unit. Since then, ACEN has institutionalized the group’s Enterprise Risk Management Policy Statement, which formalizes our commitment to incorporate the ERM processes into our core business and practices, not only to mitigate potential risks but also to identify viable opportunities.

In addition, we formalized ACEN’s Risk Appetite Statement, which provides guidance for management on how risks are identified, assessed, evaluated, and addressed. Both policy statements are approved by the Board of Directors.

Regular workshops and dialogues with different internal teams ensure we mitigate the risks in our plant operations as we aggressively grow our renewables portfolio.

Regular workshops and dialogues with different internal teams ensure we mitigate the risks in our plant operations as we aggressively grow our renewables portfolio.The Board has established clear ownership of managing enterprise-wide risks with three different management levels, with delineation around three categories: strategic, operational and project or transaction risks. This is itemized in ACEN’s Risk Ownership Structure.

In terms of risk management process, ACEN follows ISO31000:2019 Risk Management – Guidelines, which is conducted across its subsidiaries on an annual basis. To aid risk owners in the identification of enterprise wide risks, ACEN created a Risk Universe that covers external risks, internal risks, and natural hazards.

ACEN conducts risk assessment exercises wherein risk owners assess risks under four categories: health and safety, environmental impact, financial impact, and reputational impact. In 2022, the Board’s Risk Management and Related-Party Transaction Committee and senior management have reviewed the top five risks for ACEN. This aided management in prioritizing the monitoring of the risk factors and formulation and implementation of mitigation plans.

Since 2021, ACEN has been a supporter of the Task Force for Climate-Related Financial Disclosures (TCFD), established by the Financial Stability Board to develop voluntary, consistent, climate-related financial disclosures to improve transparency on climate risks and opportunities. These disclosures revolve around four thematic areas: governance, strategy, risk management, and metrics and targets.

GOVERNANCE

Board oversight on climate governance

The Board plays an integral role in ACEN’s climate agenda, including the increasing integration of climate-related issues into our broader corporate strategy. In particular, the board reviews and approves major strategic decisions proposed by senior management around energy transition, decarbonization strategy, portfolio of top risks including climate, and medium and long-term climate targets. Further, the board reviews and approves management’s specific responsibilities against ESG targets, including the development of science-based metrics and targets towards ACEN’s Net Zero goal by 2050.

In recent years, key strategic decisions of the Board have had an increased focus on climate change. These include the establishment of ACEN’s Environmental and Social Policy in 2020, which defines ACEN’s transition to a low carbon portfolio and divestment of its coal plant by 2030, as well as the commitment to Net Zero by 2050 announced in 2021. The board was likewise instrumental to the divestment of the South Luzon Thermal Energy Corporation coal plant through the landmark Energy Transition Mechanism. In addition, the Board supported management in developing ACEN’s long-term aspiration to reach 20 GW of attributable generating capacity by 2030.

To sharpen its focus on ACEN’s sustainability agenda, the Board created in 2022 the Sustainability Committee to review strategic objectives, monitor the progress of sustainability initiatives, including climate change, and lead all climate-related matters. Since its inception, the Sustainability Committee has provided oversight on ACEN’s key climate initiatives: the Net Zero commitment, transition to a low carbon portfolio and carbon emission reduction targets.

Additionally, the Board’s Risk Management and Related Party Transaction Committee has oversight of ACEN’s Enterprise Risk Management system, which includes climate risks, as well as all material related party transactions.

Management oversight on climate governance

Management is primarily responsible for the execution of Board-approved climate-related strategies and monitoring of performance. In addition, it designs and implements an adequate and effective system of internal controls and risk management processes to ensure achievement of objectives while maintaining compliance with laws, rules, and regulations.

To facilitate the flow of strategic and operational information among key decision-makers, the Company has created in 2022 the ESG Committee at the executive level to review, monitor and aid senior management and the Board on policymaking and decision-making processes around ESG issues. The Committee is composed of the functional heads of governance and compliance, sustainability, investor relations and headed by the Chief Risk, Human Resources and Administrative Officer. In addition, ACEN created the Risk and Health and Safety Committee to provide oversight on operational safety and sustainability risks.

At the corporate level, the Sustainability team has oversight in managing sustainability initiatives, climate-related risks and opportunities, as well as climate-related disclosures. At the project level, project development leads proactively mitigate physical effects of climate change in the planning and design of new projects. The Sustainability team works closely with the project development teams to ensure that any environmental issues are adequately addressed. For operating plants, plant managers, as well as health, safety, security and environment teams work closely with the Sustainability team to address any environmental issues and manage physical risks of climate change.

Know more about how our Sustainability Organizational Structure works

STRATEGY

Climate risks and opportunities

Climate action is naturally ingrained into ACEN’s long-term strategy—and not just adjacent to it. This enables us to play a leading role in the energy sector’s transformation towards a low-carbon economy, which is in our business model, outlook and strategy

Risks and opportunities related to climate change

ACEN engaged Aon Global Risk Consultants, which partnered with The Climate Service (TCS), to determine the methodology to evaluate and measure our climate risk factors. The study was conducted in 2022 involving 40 assets across ACEN’s different markets. Since the time of the study, ACEN’s portfolio has evolved, with new projects being added, while certain assets are no longer part of the group.

Using a long-term time horizon through the 2030s, we considered both a “high emissions” (RCP 8.5) and a “low emissions” scenario (RCP 4.5) to help provide a broader perspective from either potential outcome.

Natural catastrophe analysis

ACEN’s project development process includes a review of the topography, weather patterns, hydrological studies, seismological studies, volcanic activities and water levels of the site. As part of the insurance management process, ACEN avails of a natural catastrophe study for select projects called the Munich Re’s NATHAN (or Natural Hazards Edition), a leading risk tool. These help ACEN during design and construction to include engineering solutions for major risks. The study, conducted by Munich Re, a leading global insurance provider, equips ACEN in determining the optimal construction design and engineering mitigation solutions.

Climate-related opportunities and response actions

The war in Ukraine triggered the current energy global crisis, which accelerated demand from governments, businesses and consumers for clean energy sources. With elevated fossil fuel prices, renewable energy has become a more sustainable alternative. This paves the way for the emergence of clean technology that is more efficient, cost effective and reliable.

As an early mover in renewable energy in Southeast Asia, ACEN aims to capitalize on the enormous opportunities around energy transition. It has laid out an aggressive goal to accumulate 20 GW of renewables capacity by 2030. To achieve this goal, ACEN will implement three key strategies: geographic expansion, new technologies and strategic partnerships.

ACEN’s climate-related opportunities assessment focuses on energy efficiency, materials use efficiency, energy resilience, innovation in products and services and prospects in new markets.

RISK MANAGEMENT

Climate-related risks are considered in ACEN’s Enterprise Risk Management process, with climate-related physical and transition risks part of our Risk Universe. Identifying climate related risks is embedded in our project development and operations management processes. During project development, we conduct topography, weather patterns, hydrological, seismological, volcanic activities and water levels studies.

In addition, our insurance management process includes the conduct of a natural catastrophe study, the results of which are factored into the design, construction and project implementation. This also helps determining the appropriate insurance coverages for each asset.

To determine the tangible and measurable impact of climate-related risks to our business, we engaged TCS to conduct a climate analytics exercise considering RCP4.5 and RCP8.5 scenarios. The results of the study provided both climate-related risk and opportunities that ACEN management will be monitoring and mitigating or leveraging.

METRICS AND TARGETS

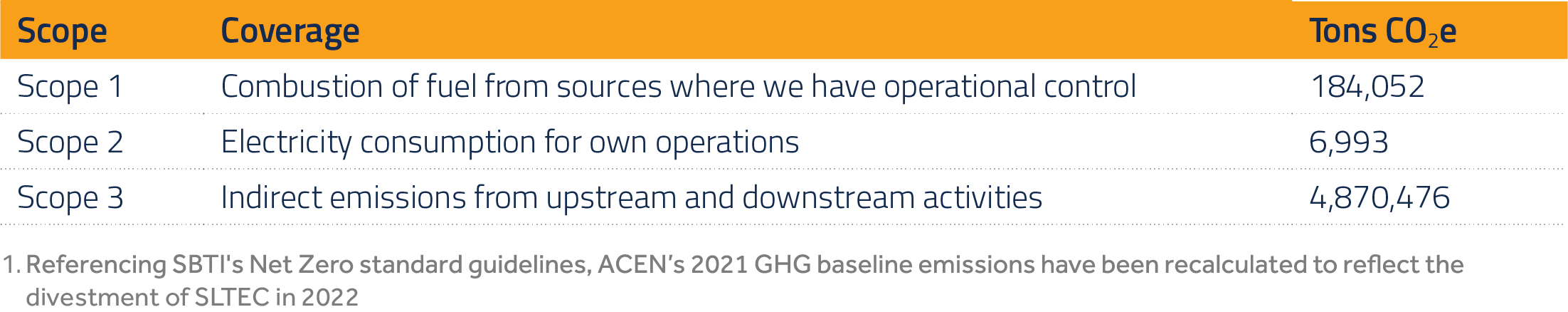

As part of its Net Zero journey, ACEN has committed to 100% renewables generation by 2025, which will result in zero Scope 1 stationary GHG emissions from the company’s generation portfolio. Under this roadmap, ACEN established near-term scope 1, 2 and 3 greenhouse gas (GHG) emissions reduction targets, aligned with a 1.5°C pathway for the power sector.

Adopting the GHG Protocol’s Corporate Accounting and Reporting Standard, ACEN validated and measured its 2021 GHG emissions1 to serve as the baseline for our Net Zero targets and roadmap.