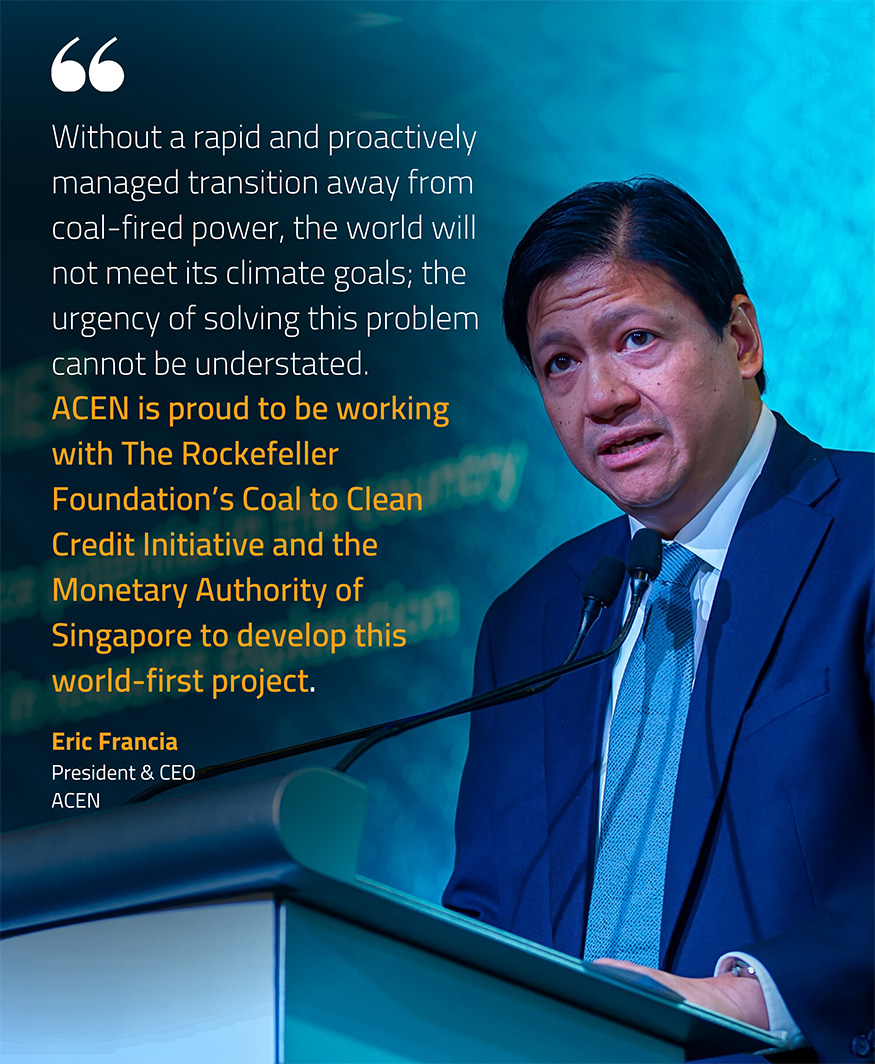

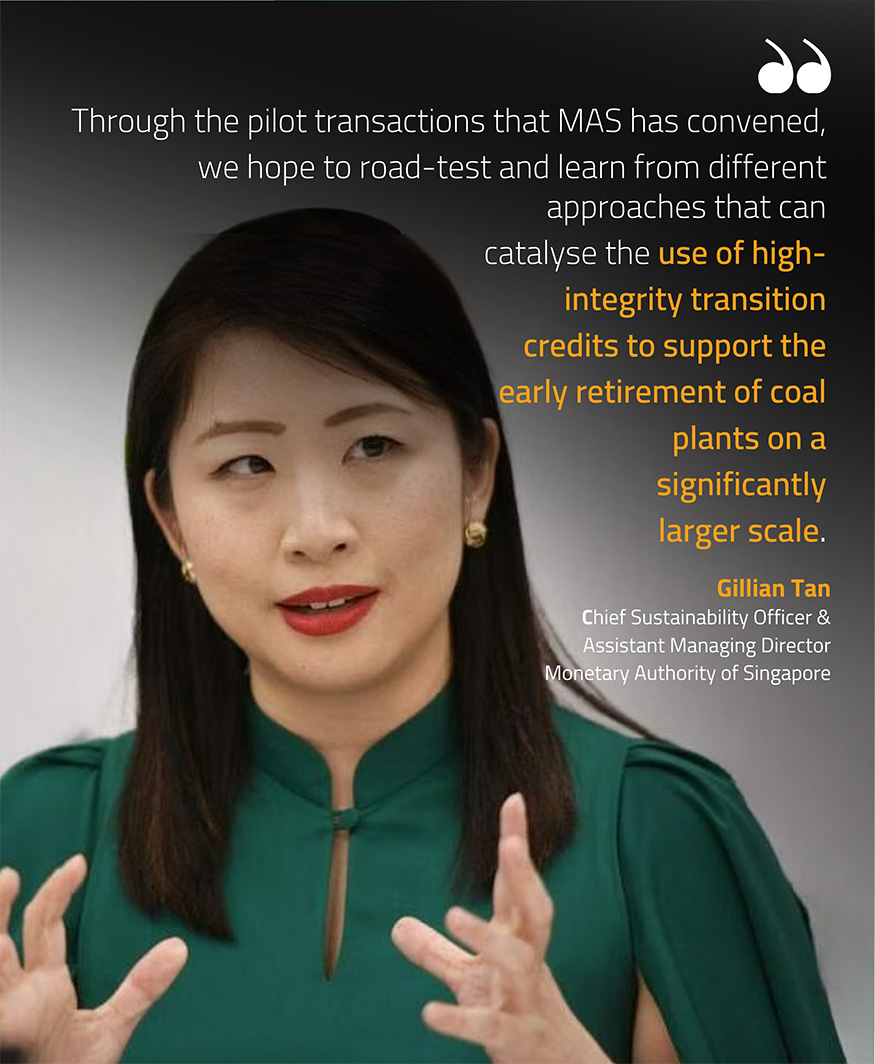

As a leader in energy transition, ACEN is looking to further accelerate the transition of SLTEC coal plant to clean technology as early as 2030, and replace the foregone generation with clean, reliable, and affordable energy. The replacement energy is likely to come in the form of Integrated Renewables and Energy Energy Storage System (IRESS) such as a combination of wind and solar power plant integrated with battery storage.

Transition Credits

- This will enable ACEN to increase its ambition of further accelerating the transition of SLTEC coal plant to clean technology as early as 2030.

- This will be an important mechanism to help ensure a just transition, ensuring affordability of the replacement energy as well as the just transition of the local community and the affected workers.

- They are high-integrity carbon credits generated from the emissions reduced through retiring coal fired power plant early and replacing this with clean energy sources

Our partners

Rockefeller Foundation

The Rockefeller Foundation is a pioneering philanthropy built on collaborative partnerships at the frontiers of science, technology, and innovation that enable individuals, families, and communities to flourish. We make big bets to promote the well-being of humanity. Today, we are focused on advancing human opportunity and reversing the climate crisis by transforming systems in food, health, energy, and finance.

Coal to Clean Credit Initiative (CCCI)

The Coal to Clean Credit Initiative (CCCI) is a consortium of global experts, led by The Rockefeller Foundation and supported by the Climate Policy Initiative and South Pole. RMI (founded as Rocky Mountain Institute) provided technical support for the creation of the draft methodology. The consortium is focused on ensuring that CCCI’s methodology is established according to the highest level of environmental integrity, technical best-practice, and credible, cross-societal stakeholder engagement.