L-R) : Asian Development Bank director for infrastructure finance division Jackie Surtani, RCBC executive vice president of corporate banking Elizabeth Coronel, BPI senior vice president Barbara Ann Untalan, Government Service Insurance System president and general manager Jose Arnulfo “Wick” Veloso, ACEN president & CEO Eric Francia, Insular Life chairperson Nina Aguas and EPHI president Ronald Goseco.

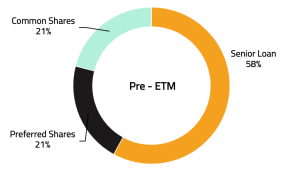

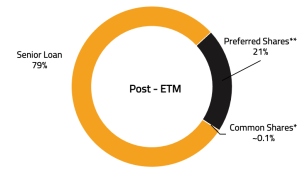

Equity ₱3.7 Bn

Debt ₱13.7 Bn

First

market-based

ETM in the world

246 MW

Net dependable capacity

Unit 1 – April 2015

Unit 2 – February 2016

Start of Operations

Sub-critical Circulating

Fluidized Bed (CFB)

Calaca, Batangas,

Philippines

South Luzon Thermal Energy Corporation (SLTEC)