Climate change

Climate change

and the energy transition

The announcement of our Net Zero by 2050 ambition in 2021 and the launch of our Net Zero roadmap in 2023 — the first energy company in Southeast Asia to take such a critical step — demonstrates our commitment to climate action. Our roadmap includes near-term emission reduction targets by 2030 aligned with the GHG Protocol and the latest climate-science and long-term targets by 2040 that are consistent with the deep decarbonization of the power sector.

Since then, we conducted the following activities to ensure that efforts to implement our targets and address remaining gaps on emissions reduction:

2030 target achieved

For scope 1 emissions from own generation

55% reduction

Scope 1 emissions vs baseline

Our targets, strategies and performance

Target 1 addresses scope 1 emissions from our own generation activities.

Target 2 addresses scope 1 emissions from sources other than own electricity generation, such as from fleet vehicles and scope 2 emissions from electricity consumption.

Target 3 addresses scope 1 and scope 3 emissions from our own generation and retail electricity activities.

Target 4 addresses the remaining scope 3 emissions from upstream and downstream activities, including purchased goods and services, capital goods, fuel- and energy-related emissions not covered in target 3, upstream transportation and distribution, upstream leased assets, waste, employee commuting, business travel and investments.

Having established strategies to address our primary emission hotspot – scope 1 emissions from generation activities – we are now directing our efforts toward addressing the next key sources of emissions: supply chain and purchased electricity. We are closely collaborating with our business units to integrate Net Zero strategies and targets at every step of project development and operations.

ACEN president and CEO Eric Francia joined the 2024 Climate Week NYC, the biggest annual climate event of its kind. He joined key figures in a panel discussion entitled “Harnessing Transition Credits to Drive a Coal to Clean Transition in Emerging Markets” where he emphasized the significant role of transition credits in overcoming the challenges of the energy transition in emerging markets.

Pioneering energy transition

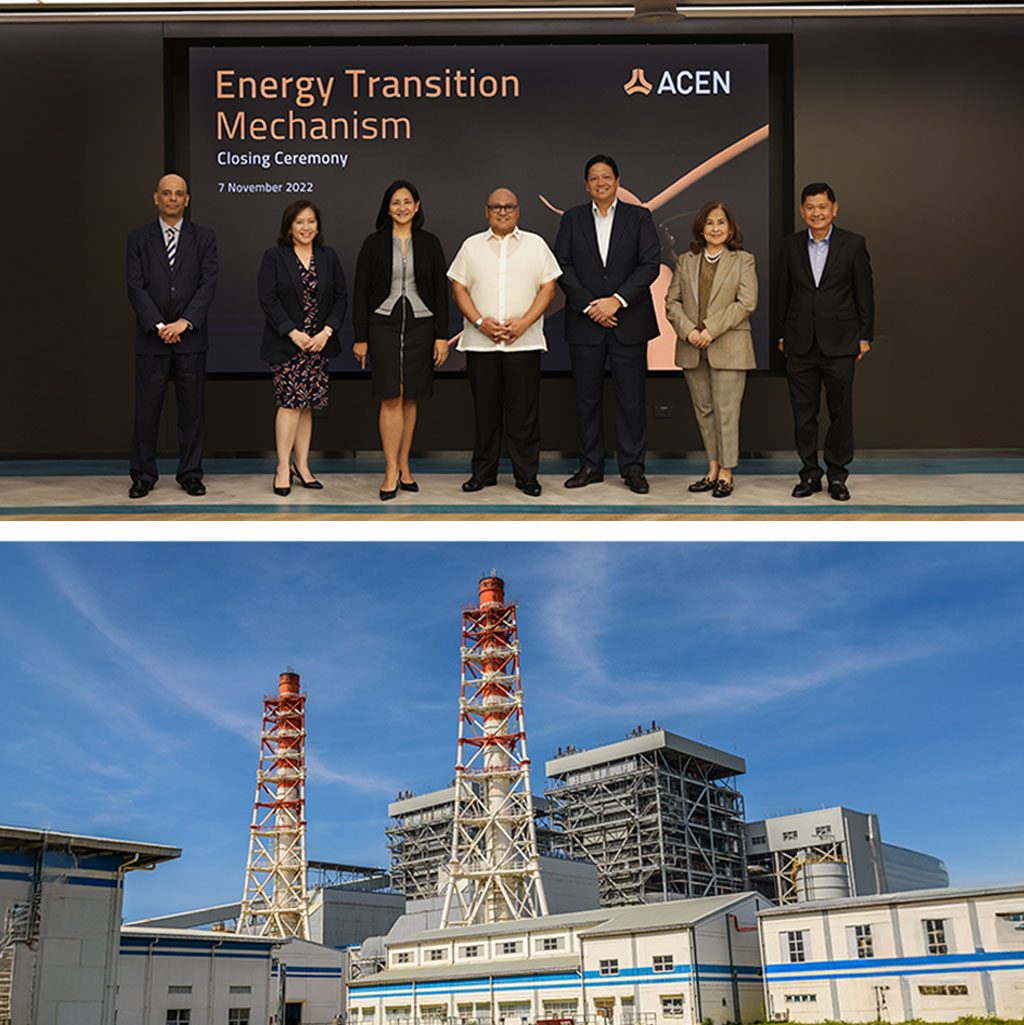

2022

In November 2022, we completed the world’s first market-based Energy Transition Mechanism transaction for the divestment and early retirement of the 246 MW SLTEC coal plant in the Philippines.

2023

At COP28, we announced our partnership with The Rockefeller Foundation’s Coal to Clean Credit Initiative (CCCI) and the Monetary Authority of Singapore (MAS) to develop the world’s first Transition Credits project that would leverage carbon finance to phase out a coal-fired power plant and replace it with renewable energy, in line with the Paris Agreement.

2024

In August, we signed a Memorandum of Understanding (MOU) with GenZero and Keppel Ltd. to jointly explore the origination and utilization of Transition Credits to accelerate the retirement of the SLTEC coal plant, and replace it with a clean energy dispatch facility.

Climate adaptation

and resilience

The 363 MW Palauig Solar (Phases 1 & 2) is one of our large-scale development projects in Zambales, Philippines.

We proactively identify and address the environmental and social risks across our projects, including climate risks, through our Environment and Social Management System (ESMS). We determine which among our operational plants are prone to physical risks, including tropical cyclones, flooding, water stress, drought, wildfires and extreme temperatures. We also identify climate risk adaptation and mitigation measures as part of our environmental assessment studies during the development phase. These studies play a crucial role in shaping engineering solutions that will help optimize our construction design and operational and management plans.

In the Philippines, for instance, we implement adaptive work schedules and heat index monitoring to safeguard workers during extreme heat, while continuously enhancing emergency response plans for cyclones, floods, wildfires and extreme temperature as aligned with international standards. To reduce the risk of wildfires, we establish fire breaks and regular vegetation management.

In Vietnam and Australia, advanced weather tracking software and early warning systems are deployed to enable proactive responses to extreme weather events. This is supported through local fire brigade engagement and completion of emergency preparedness scenarios at the facility. These comprehensive measures not only address immediate climate risks, but also pave the way for sustainability certifications and green financing opportunities.