Our commitment to ESG

drives meaningful impact

for all our stakeholders

Reports

Presentations

Key messages from the

2025 Annual Stockholders’

Meeting

Cezar Consing

Chairman

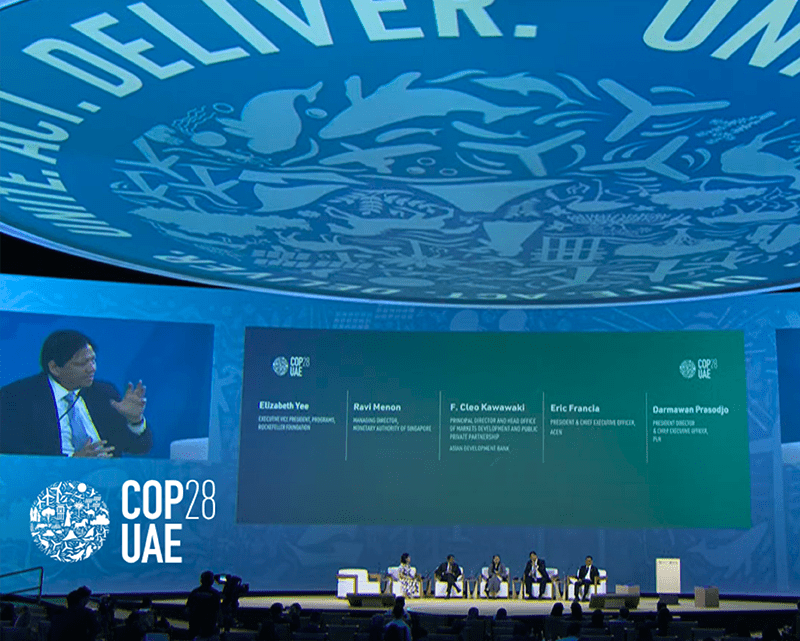

Eric Francia

President and CEO

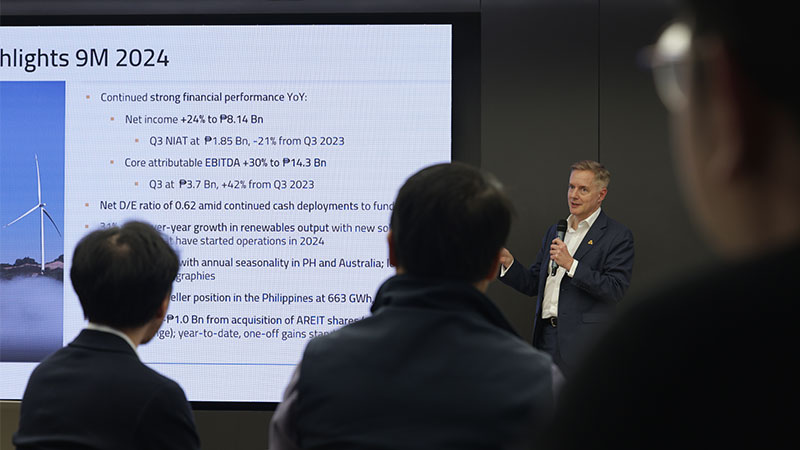

Business highlights

from 2024 Integrated Report

Investments in renewables (CapEx)

P48

billion

Financial

Core attributable EBITDA

P19.3

billion

25% increase YOY

Net income

P9.36

billion

27% increase YOY

Total asset value

P329.5

billion

Market Capitalization

~P157.4

billion

as of end-2024

Total shareholders’ equity

P157.4

billion

7

GW

Attributable renewables capacity

Renewables growth

19

Solar projects

14

Wind projects

ACEN also has strategic investments in geothermal energy and battery energy storage systems.

Attributable output from renewable sources

5,596

GWh

25% increase YOY

Completion of the Philippines’ largest wind and solar projects

545

MW

Retail electricity supply growth

374

MW

36% increase YOY in commercial and industrial customers

New strategic partnerships

In focus

ACEN: Green Finance Leadership

ACEN is the largest issuer of green bonds in the Philippines with over $1B green bonds raised.

Maiden Peso-denominated Preferred Shares

ACEN marked the issuance of its ₱25.0 billion perpetual preferred shares, listed on the PSE on September 2023.